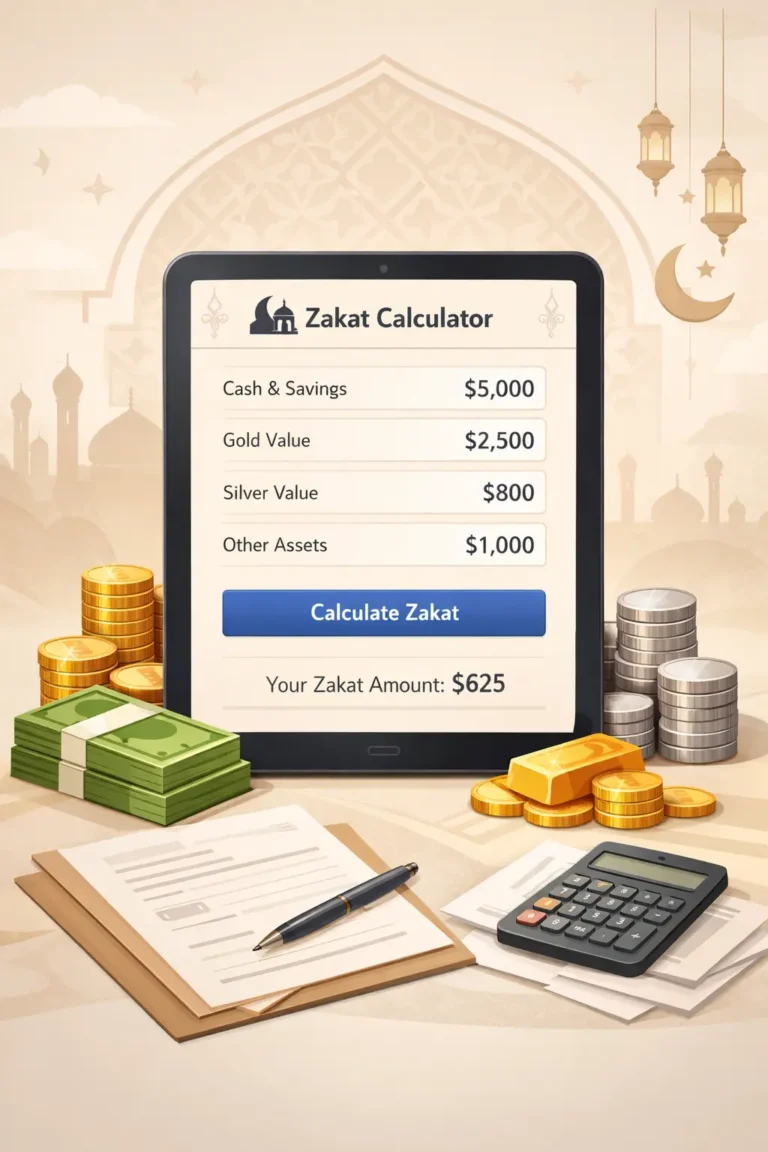

Zakat Calculator

Enter all values in the same currency. This calculator works for any currency worldwide.

0

0

0

About Zakat Calculator

This Zakat Calculator is designed to help Muslims calculate their Zakat accurately and with ease. It allows you to include cash savings, gold and silver based on current market prices, other zakat-eligible assets, and deductible liabilities to determine your net zakatable wealth. The calculator then applies the standard 2.5% Zakat rate to provide a clear and reliable estimate of your Zakat obligation. Since it works with any currency, it is suitable for users worldwide and helps make fulfilling your religious duty simpler and more transparent.

How Your Zakat Is Calculated?

This Zakat Calculator adds together your zakat-eligible assets, including cash savings, gold, silver, and other assets. Any outstanding debts or liabilities are deducted to determine your net zakatable amount.

Once the net amount is calculated, a standard Zakat rate of 2.5% is applied. If your wealth meets or exceeds the Nisab threshold, Zakat becomes obligatory. Since gold and silver prices change frequently, you can manually enter current prices for accurate results.

How to Use (Simple Steps):

- Enter your cash savings in the input field.

- Enter the weight of your gold and its current price per gram.

- Enter the weight of your silver and its current price per gram.

- Add any other zakat-eligible assets value you own.

- Enter any debts or liabilities value to subtract from your total assets.

- Verify the Zakat rate (default is 2.5%) or adjust if needed.

- Click “Calculate Zakat” to see your Total Assets, Net Zakatable Amount, and Zakat Payable.

- Use the “Reset Calculator” button to clear all fields and start fresh.

Frequently Asked Questions (FAQs)

Zakat is a mandatory charitable obligation in Islam, requiring eligible Muslims to give 2.5% of their qualifying wealth to those in need. It is one of the Five Pillars of Islam and plays an essential role in promoting social justice and economic balance within the Muslim community.

Zakat becomes obligatory when a person’s wealth reaches or exceeds the Nisab threshold and remains in their possession for one full lunar year (Hawl).

Yes, this Zakat Calculator is currency-neutral. You can enter all values in the same currency, whether PKR, USD, AED, or any other, and it will calculate your Zakat correctly.

Any debts or liabilities you owe can be subtracted from your total assets. This reduces your net zakatable wealth, which in turn lowers your Zakat payable.

Nisab is the minimum amount of wealth a Muslim must have before Zakat becomes obligatory. If your total zakatable wealth reaches or exceeds the Nisab threshold, Zakat must be paid. This calculator helps you determine whether your wealth meets the Nisab requirement.

Absolutely! The calculator is simple and user-friendly. It guides you step-by-step, making it easy for anyone to calculate their Zakat quickly and accurately.